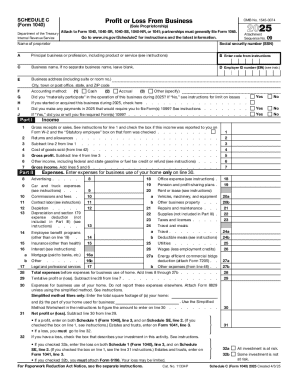

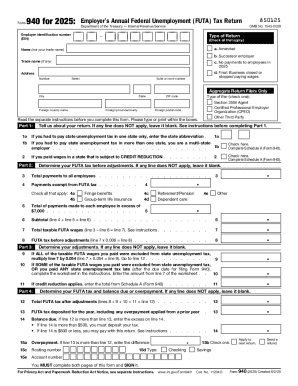

IRS 941 - Schedule B 2024-2026 free printable template

Instructions and Help about IRS 941 - Schedule B

How to edit IRS 941 - Schedule B

How to fill out IRS 941 - Schedule B

Latest updates to IRS 941 - Schedule B

All You Need to Know About IRS 941 - Schedule B

What is IRS 941 - Schedule B?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 941 - Schedule B

What should I do if I realize I made a mistake on my IRS 941 - Schedule B after submitting it?

If you discover an error on your IRS 941 - Schedule B after filing, you should file an amended return using Form 941-X. This allows you to correct any mistakes made in your original submission, ensuring that your tax records are accurate. Make sure to follow the specific guidelines for any changes and retain documentation to support your amendments.

How can I verify the status of my submitted IRS 941 - Schedule B?

To verify the status of your filed IRS 941 - Schedule B, you can use the IRS's Online Account tool or call the IRS directly. Keep in mind that processing times can vary, so it's advisable to wait a few weeks after submission before checking. If your e-filed return is rejected, the IRS will provide specific rejection codes to address any issues.

What are the common errors to avoid when filing IRS 941 - Schedule B?

Common errors when filing IRS 941 - Schedule B include inconsistent employee data, incorrect calculation of tax liability, and failure to sign the form if required. Double-check all figures and ensure compliance with reporting requirements to minimize the risk of processing delays or audits. Familiarize yourself with potential error codes to resolve issues quickly.

Are there specific security measures I should take when e-filing IRS 941 - Schedule B?

When e-filing your IRS 941 - Schedule B, ensure that you use a secure internet connection and trusted software to protect sensitive information. Additionally, be aware of the IRS guidelines on e-signatures and data retention periods to ensure compliance and safeguard your data from unauthorized access.

See what our users say